The first companies have been pushing their digital supply chain transformations, resulting in significant impact on service, costs, capital, agility, and especially on customer experience.

Supply Chain 4.0 has tremendous potential. The set of innovative digital technologies it offers could help companies reduce lost sales by 65 to 75 percent and cut transportation and warehousing costs by 15 to 30 percent. Improved planning would make inventory reductions of 35 to 75 percent possible and supply chain administrative costs could be 50 to 80 percent lower. The levers identified for realizing this potential are clear, but to what extent can they already be put into use today?

Innovations addressing all aspects of the supply chain are emerging – from robotics and autonomous vehicles in logistics to use of predictive analytics in demand planning to technologies enabling no-touch order management. Although the supply chain community is aware of most of these concepts, few practitioners are sure if they can really be applied today or if the ideas are more visionary, requiring another 10 years before they be used regularly. Therefore, a certain skepticism regarding Supply Chain 4.0 is the result – supply chain professionals are unsure whether to focus on applying these innovations now and have the first-mover advantage or to wait for more stable solutions to be developed.

Supply Chain 4.0 survey shows that innovations are becoming ”real”

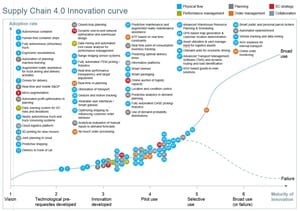

To better understand the landscape of supply chain innovations – including their maturity, how they are being applied, and what impact can be expected from them – McKinsey & Company conducted a survey in 2016 with senior supply chain experts from industry, research,

and consulting that covered all regions, industries, and supply chain areas. A total of 53 innovations spanning across the entire supply chain were analyzed to determine where to focus now in

order to maximize the impact of Supply Chain 4.0.

The results are promising: Up to 40 innovations had already been piloted or had even been selectively used, while another 13 were expected to reach this stage within the next five years (Exhibit 1). Furthermore, the survey concluded that 40 innovations will be in broad use within the next four to five

years. These results suggest that it’s the right time to move into Supply Chain 4.0. Early adopters can

gain significant competitive advantages now by deploying Supply Chain 4.0 innovations that are

already proven to work.

Innovations in physical flow (warehousing and transport) account for a large share of supply

chain advances due to significant progress made in advanced robotics and human-machine interaction in recent years. For example, automated guided vehicles (AGVs) and augmented reality are already being applied in warehousing, while global corporations such as Google, Uber, and Daimler are developing drones and autonomous vehicles and pushing their use in transportation.

At the same time, a lot of progress has been made in planning and order management thanks to predictive analytics, machine learning, and the automation of IT processes. Many companies across industries are running pilots or even implementing predictive analytics in demand planning to improve their forecasting, cutting the number of forecasting errors in half. Sales and operations planning is also upgraded via automatic scenario planning and by pushing decision-making cycles to near real-time interaction. This is complemented by no-touch order management, automating the entire order-to-delivery process through the use of robotic process-automation techniques.

During the past two years, it has also been shown that purely implementing selected supply chain technologies is not sufficient to create a step-change in performance. Rather, companies need to rethink their approach to supply chain management (SCM) and embark on a broader digital supply chain transformation. Core components include integrating an agile way of working, adapting organizational and IT structures to enable constant innovations, and rewarding selected risk taking. Initially implemented digital SCM transformations are highlighting the huge impact that can be achieved through such a Supply Chain 4.0 journey, often improving EBIT by 2+ percentage points through supply chain alone.

Exhibit 1: Supply Chain 4.0 innovation curve 2016.

Nine supply chain technology clusters are shaping the future

We typically differentiate between nine supply chain technology clusters, which are outlined in Exhibit 2. The first technology cluster is around advanced robotics in warehousing. Driverless transport systems and automatic high-bay warehouses have been an integral part of intralogistics for decades. However, industrial robotics are on the brink of revolutionizing warehousing with so-called robotic mobile fulfillment systems (RMFS). Amazon has been the pioneer in warehouse automation. Since its acquisition of the manufacturer Kiva Systems in 2012, Amazon has already put 80,000 RMFS in use that minimize the pickers’ walking distances and increase their productivity by up to 100 percent. However, robotics in warehousing is not only attracting attention in e-commerce, but it’s also enabling automated picking for supermarkets. For example, German grocery chain Edeka opened a facility in 2015 where the entire range of dry, frozen, and fresh products is fully automatically picked. This solution was first rolled out in regions where it was difficult to find warehouse personnel.

Automation is reshaping physical flows in both transport and warehousing

Autonomous transport and delivery technologies have been enabled by the recent advances in sensor technology and image processing. We differentiate between technologies for long haul transport and for last mile delivery. With long haul trucks, automation does not (yet) mean the absence of a driver, but rather comprehensive assistance and support systems. One example here could be platoons of multiple trucks driving in very short distances to use slipstream effects that enable fuel savings of 4 to 5 percent and that reduce the drivers’ time. Fully automated iotrucks will initially be seen on major highways, where traffic is less complex. They can be used on a 24/7 basis without having to account for any driver rest periods. The trucks’ functions would, however, need to be taken over by human drivers once exiting the highway. In October 2016, Uber sent a fully automated truck on public roads for the first time and delivered 50,000 cans of beer along a stretch of 120 miles. Besides the technological challenges, there are also clear regulatory and insurance-related challenges to be resolved before autonomous vehicles can become mainstream. For last mile delivery, air and ground drones are currently being tested by many parcel services providers. There is a debate as to whether drones flying in cities will deliver a significant proportion of shipments in the medium to long term. However, for special applications (e.g., transporting samples between hospitals and laboratories or shipping drugs to nearby islands), the business case for drones is already convincing.

Virtual and augmented reality applications have been in existence for many years. Augmented reality (AR) is the combination of real and virtual worlds, for example, displays that bring information directly into the user’s field of vision (e.g., heads-up displays in fighter jets or premium cars). Smart glasses with AR capabilities, such as the Google Glass, sparked a public debate on its possible uses and the impact of technologies on privacy. Meanwhile, providers such as Ubimax, Vuzix, and Epson offer similar wearables equipped with software features for professional applications. For example, smart glasses have been deployed for aircraft maintenance and medical visualization applications. In an SCM context, pick-by-vision solutions inform the warehouse worker about the next article to be picked and provide precise information on its position and quantity, including potential routing within the warehouse. Order picking is then confirmed by an integrated camera that reads the barcode on the product. Related to AR is virtual reality (VR), within which ”digital twins” can support the planning, design, and construction of a production plant.

IoT and smart sensor applications are enabled by direct communication between machines and cost-efficient devices with sensor technology, Internet connectivity, and sufficient processing power. IT equipment supplier Cisco predicts that more than 50 billion devices will be connected to the Internet of Things (IoT) by 2020. Sensors make it possible, for example, to record geo information, detect environmental conditions (e.g., temperature, humidity, or vibrations), and measure stock levels. An initial key field of application is in transportation, where shipments are being equipped with sensors that track temperature-sensitive goods or record the unauthorized opening of containers by measuring the incidence of light. The providers promise to monetize investments through lower insurance premiums, increasing market shares, and the provision of additional services. Another application of smart devices is smart replenishment. Amazon has introduced the ”Dash” button, which enables customers to replenish goods with a simple click of the button and therefore, also generates a new business model. Some manufacturers have already integrated sensors into their products that automatically record the inventory level. For example, Miele offers washing machines with integrated detergent containers that allow customers to track the level of washing powder by smartphone and approve the machines’ order proposals.

Automation is reshaping physical flows in both transport and warehousing

Autonomous transport and delivery technologies have been enabled by the recent advances in sensor technology and image processing. We differentiate between technologies for long haul transport and for last mile delivery. With long haul trucks, automation does not (yet) mean the absence of a driver, but rather comprehensive assistance and support systems. One example here could be platoons of multiple trucks driving in very short distances to use slipstream effects that enable fuel savings of 4 to 5 percent and that reduce the drivers’ time. Fully automated iotrucks will initially be seen on major highways, where traffic is less complex. They can be used on a 24/7 basis without having to account for any driver rest periods. The trucks’ functions would, however, need to be taken over by human drivers once exiting the highway. In October 2016, Uber sent a fully automated truck on public roads for the first time and delivered 50,000 cans of beer along a stretch of 120 miles. Besides the technological challenges, there are also clear regulatory and insurance-related challenges to be resolved before autonomous vehicles can become mainstream. For last mile delivery, air and ground drones are currently being tested by many parcel services providers. There is a debate as to whether drones flying in cities will deliver a significant proportion of shipments in the medium to long term. However, for special applications (e.g., transporting samples between hospitals and laboratories or shipping drugs to nearby islands), the business case for drones is already convincing.

Virtual and augmented reality applications have been in existence for many years. Augmented reality (AR) is the combination of real and virtual worlds, for example, displays that bring information directly into the user’s field of vision (e.g., heads-up displays in fighter jets or premium cars). Smart glasses with AR capabilities, such as the Google Glass, sparked a public debate on its possible uses and the impact of technologies on privacy. Meanwhile, providers such as Ubimax, Vuzix, and Epson offer similar wearables equipped with software features for professional applications. For example, smart glasses have been deployed for aircraft maintenance and medical visualization applications. In an SCM context, pick-by-vision solutions inform the warehouse worker about the next article to be picked and provide precise information on its position and quantity, including potential routing within the warehouse. Order picking is then confirmed by an integrated camera that reads the barcode on the product. Related to AR is virtual reality (VR), within which ”digital twins” can support the planning, design, and construction of a production plant.

IoT and smart sensor applications are enabled by direct communication between machines and cost-efficient devices with sensor technology, Internet connectivity, and sufficient processing power. IT equipment supplier Cisco predicts that more than 50 billion devices will be connected to the Internet of Things (IoT) by 2020. Sensors make it possible, for example, to record geo information, detect environmental conditions (e.g., temperature, humidity, or vibrations), and measure stock levels. An initial key field of application is in transportation, where shipments are being equipped with sensors that track temperature-sensitive goods or record the unauthorized opening of containers by measuring the incidence of light. The providers promise to monetize investments through lower insurance premiums, increasing market shares, and the provision of additional services. Another application of smart devices is smart replenishment. Amazon has introduced the ”Dash” button, which enables customers to replenish goods with a simple click of the button and therefore, also generates a new business model. Some manufacturers have already integrated sensors into their products that automatically record the inventory level. For example, Miele offers washing machines with integrated detergent containers that allow customers to track the level of washing powder by smartphone and approve the machines’ order proposals.

Exhibit 2: Overview of SC 4.0 Technology Clusters.

Advanced analytics enables a step-change in SC performance

Core SC analytics technologies deal with the use of analytics in overarching SCM processes. These technologies play a key role in improving transparency, security, and steering of the supply chain. Probably the most well-known example in this cluster is the use of blockchains in SC management. Blockchain technology has been developed as a means for enabling secure transactions without involving a trusted mediary. Although public blockchains – such as those being used by bitcoin – are best known, private blockchains are being applied by some companies to ensure proof of contract or origin in the supply chain. For example, Bosch is implementing blockchains to enable a means for proofing the authenticity of ”original Bosch spare parts.” On the other hand, smart contracts can also be established through this technology to help automate some business relationships and automatically reorder certain materials when stock levels fall below a predefined threshold, for instance. Another technology within this cluster addresses the increased transparency achieved through advanced SC performance management with automatic root cause analyses, leveraging machine learning approaches and readjusting SC planning parameters in near real time.

Analytics for end-to-end SC planning leverages advanced analytics methods and a wide range of company-internal and -external data sources to improve planning along the entire supply chain. For example, many companies calculate the available-to-promise (ATP) finished goods inventory based on rather static assumptions that are updated only at regular intervals. Analytics can enable companies to run a near real-time ATP based on real-time capacity constraints, component inventories, and confirmed supplier lead times. Another example is the advanced analytics company Blue Yonder, which is using machine learning approaches to improve the forecast accuracy of 130,000 articles for a large Germany-based retailer with about 200 influencing variables and 150 billion probability distributions. This approach not only results in better forecasting accuracies, but it has tangible effects on availability and obsolescence cost at the same time, e.g., cutting the latter by a factor of 10, as the mentioned Blue Yonder retailing case shows. It can even be further enhanced by linking demand planning with pricing, inventory management, and replenishment decisions and optimizing the system as a whole, which we call ”closed-loop planning.” Additional opportunities can also be created in manufacturing companies, e. g., by planning energy-intensive manufacturing processes in such a way that peak loads are minimized or by using sensor data for preventive maintenance.

Analytics for transport and warehousing are specific analytics applications for improving individual processes in the physical supply chain. In warehousing, many companies are now applying an analytics-based warehouse design in order to, for example, ensure that fast-moving items are identified and stored in different locations than are the slow-moving items. Furthermore, warehouse staff can be better planned using analytics on performance data and in line with more accurate sales forecasts. For example, Germany-based online fashion retailer Zalando is using weather forecasts to better forecast daily sales. This information is then used to schedule workers in line with demand to avoid overtime. Analytics is also becoming more relevant in transport planning, leveraging information from vehicle tracking and data mining. For example, companies use traffic and weather information to improve their projections of the estimated time of arrival (ETA) and to better estimate when a customer is home and should be served. This available live data can also be used to trigger an automatic rerouting of the delivery trucks.

Process automation is aimed at overcoming the many manual activities that are still present in SCM. In particular, highly manual processes such as data input or repetitive analysis in which large amounts of data are used offer great potential for automation to help eliminate high costs and frequent errors. Order processing, and sales and operations planning (S&OP) are just two examples of supply chain processes that benefit significantly from automation. The vision of ”no-touch” order processing describes that no human intervention is required in the entire process. In the B2C sector, for example, Amazon is already close to this vision with its hands-off-the-wheel program. Here, the first human activity in the entire ordering process is often the picking of goods from the Kiva-operated shelf. Consequently, some manual activities are still included in the materials flow, while the information flow is processed and controlled automatically. But more traditional industrial companies are also embarking on no-touch order management journeys. Typically, S&OP is performed at certain discrete intervals, e.g., monthly. In this way, short-term deviations from the plan cannot be identified systematically. The vision of real-time S&OP enables the permanent comparison of planned values with actual data. Larger deviations are detected in time and can send an alert for manual intervention as required. Some solutions already enable this through mobile collaboration among the S&OP users.

Collaboration and crowd platforms enable companies to exchange data and services with other participants in the supply chain at any time and from any location. Thus, they serve as the prerequisite for developing cooperation platforms among various companies along the supply chain. Information can be exchanged cost efficiently and often in real time without complex integration scenarios. For the transport industry, this networking can generate both positive and negative consequences. While the customers are strengthening their positions through improved transparency and collaboration, logistics service providers (LSPs) will struggle to compensate if they don’t find the right solution. Certainly, one option is that the LSPs offer, as a new business model, to link SC participants to their own platform and therefore, make a margin with this service. Crowd platforms use cloud solutions to collectively harness resources (e.g., financial, intellectual, or material) of individuals for traditional business activities along the value chain. Uber, initially known only for passenger transport, offers as part of Uber Freight services that transfer the original concept of passenger transport to the logistics market. Similar platforms are developing in many application areas. For example, RIO, which is supported by MAN Truck & Bus, created a cross-manufacturer cloud-based platform for freight transport that bundles digital services from the entire logistics chain. In this way, data from the most diverse areas such as tractors, trailers, superstructures, and drivers are combined with data on weather and traffic in order to provide recommendations for action in real time. In addition, a digital marketplace enables third parties to offer their customized solutions.

In summary

All technology clusters outlined here have the potential to fundamentally change the way supply chains operate. We have seen this before: Some technologies, such as the container, have altered supply chains and even affected global economies. Other technologies however, such as RFID used in supermarkets, have not really gotten off the ground even though lots of hype was created for them by the various stakeholders. Developments over the next few years will show which technology clusters are most influential and which will fail to meet the high expectations. However, it is already clear today that most supply chains in the year 2025 will differ significantly from those of 2015. They will be more efficient, more customized, faster, and safer, and will provide a much better customer experience. Supply chain management is a strong contributor to companies’ performance and leveraging innovations in supply chain will help drive cross-functional excellence in costs, capital, and service.

In order to account for the quickly changing nature of Supply Chain 4.0 and the progress of many supply chain innovations that has occurred over the past 18 months, McKinsey is now updating its supply chain innovation survey. If you would like to participate in a survey for this purpose, please contact Christoph Lennartz (christoph_lennartz@mckinsey.com) to receive an invitation and login password – and be one of the first to receive the results and insights generated. The deadline for participation March 15, 2018. Results will be published in Q2 2018.